Health Savings Accounts (HSAs): What You Need to Know

HSAs are misunderstood and underused. Congress created them so those with HDHPs could save for medical expenses not covered by insurance.

Employers Should Approach Payroll Tax Deferral Cautiously

President Trump signed an executive memo on August 8 for a payroll tax deferral. It creates uncertainty re: administrative compliance and long-term impact.

New Opportunity For $500 Economic Impact Payments for Children

The IRS reopens registration for those with children who didn't receive Economic Impact Payments. Did you receive your $500/child stimulus payment?

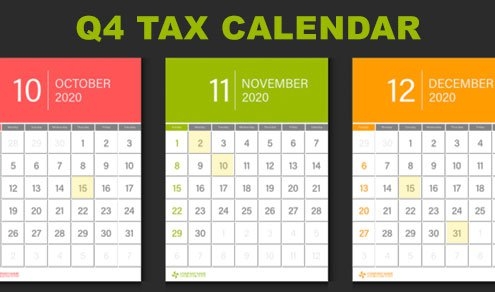

Key Tax Deadlines for Businesses and Employers in Q4 2020

Here are key tax-related deadlines for businesses and employers in Q4 2020. This list isn’t all-inclusive; additional deadlines may apply to you.

Stimulus Checks Issued to Decedents Cancelled by the IRS

The Treasury Dept. has cancelled outstanding stimulus checks issued to ineligible recipients. This includes those declared deceased.

Qualified retirement plan rules affect COVID-19-related layoffs and rehires

Have you laid off employees because of COVID-19? Plan to rehire some of them before 2020 ends? If so, and you offer a qualified retirement plan, listen up!