https://blog.fiducial.com/wp-content/uploads/2019/12/vNJCl756hwUZ0qIXO2a8.png

292

560

fiducial

https://blog.fiducial.com/wp-content/uploads/2024/02/Fiducial-logo-horizontal-black-300x51.png

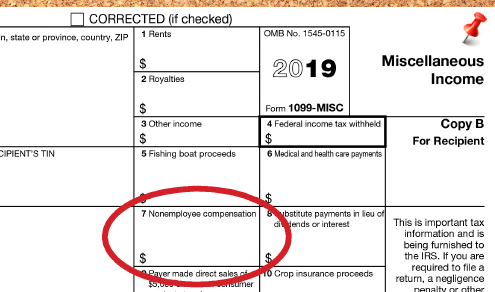

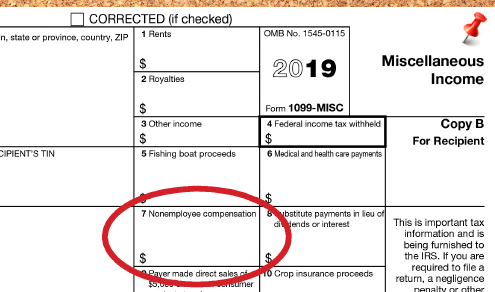

fiducial2019-12-09 14:45:112019-12-09 14:45:11It's That Time of Year: Start Getting your Form 1099-MISC's Together

https://blog.fiducial.com/wp-content/uploads/2019/12/vNJCl756hwUZ0qIXO2a8.png

292

560

fiducial

https://blog.fiducial.com/wp-content/uploads/2024/02/Fiducial-logo-horizontal-black-300x51.png

fiducial2019-12-09 14:45:112019-12-09 14:45:11It's That Time of Year: Start Getting your Form 1099-MISC's Together https://blog.fiducial.com/wp-content/uploads/2019/12/vNJCl756hwUZ0qIXO2a8.png

292

560

fiducial

https://blog.fiducial.com/wp-content/uploads/2024/02/Fiducial-logo-horizontal-black-300x51.png

fiducial2019-12-09 14:45:112019-12-09 14:45:11It's That Time of Year: Start Getting your Form 1099-MISC's Together

https://blog.fiducial.com/wp-content/uploads/2019/12/vNJCl756hwUZ0qIXO2a8.png

292

560

fiducial

https://blog.fiducial.com/wp-content/uploads/2024/02/Fiducial-logo-horizontal-black-300x51.png

fiducial2019-12-09 14:45:112019-12-09 14:45:11It's That Time of Year: Start Getting your Form 1099-MISC's Together