https://blog.fiducial.com/wp-content/uploads/2023/10/fiducial-blog-image-business-partners_87f2c4b4f82f06fc7226086b3b7a07b3_2000.jpg

788

940

Kelly Cockerham

https://blog.fiducial.com/wp-content/uploads/2024/02/Fiducial-logo-horizontal-black-300x51.png

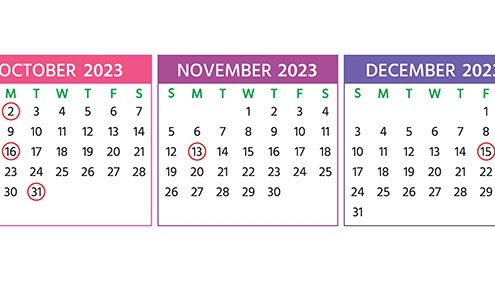

Kelly Cockerham2023-10-04 14:00:372023-10-04 14:00:37The Partner Employee Issue

https://blog.fiducial.com/wp-content/uploads/2023/10/fiducial-blog-image-business-partners_87f2c4b4f82f06fc7226086b3b7a07b3_2000.jpg

788

940

Kelly Cockerham

https://blog.fiducial.com/wp-content/uploads/2024/02/Fiducial-logo-horizontal-black-300x51.png

Kelly Cockerham2023-10-04 14:00:372023-10-04 14:00:37The Partner Employee Issue https://blog.fiducial.com/wp-content/uploads/2023/10/fiducial-blog-image-business-partners_87f2c4b4f82f06fc7226086b3b7a07b3_2000.jpg

788

940

Kelly Cockerham

https://blog.fiducial.com/wp-content/uploads/2024/02/Fiducial-logo-horizontal-black-300x51.png

Kelly Cockerham2023-10-04 14:00:372023-10-04 14:00:37The Partner Employee Issue

https://blog.fiducial.com/wp-content/uploads/2023/10/fiducial-blog-image-business-partners_87f2c4b4f82f06fc7226086b3b7a07b3_2000.jpg

788

940

Kelly Cockerham

https://blog.fiducial.com/wp-content/uploads/2024/02/Fiducial-logo-horizontal-black-300x51.png

Kelly Cockerham2023-10-04 14:00:372023-10-04 14:00:37The Partner Employee Issue