https://blog.fiducial.com/wp-content/uploads/2022/09/2022Q3TaxDeadlinesBlogImage_38fae7f71e62e9d0ddc7d4f2c295f860_2000.png

1125

2000

Fiducial North America

https://blog.fiducial.com/wp-content/uploads/2024/02/Fiducial-logo-horizontal-black-300x51.png

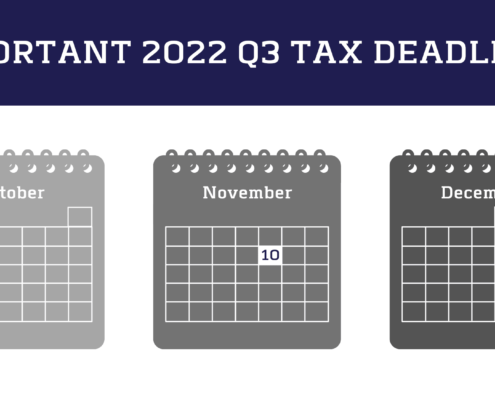

Fiducial North America2022-09-30 13:00:222022-09-30 13:00:222022 Q4 tax calendar: Key deadlines for businesses and other employers

https://blog.fiducial.com/wp-content/uploads/2022/09/2022Q3TaxDeadlinesBlogImage_38fae7f71e62e9d0ddc7d4f2c295f860_2000.png

1125

2000

Fiducial North America

https://blog.fiducial.com/wp-content/uploads/2024/02/Fiducial-logo-horizontal-black-300x51.png

Fiducial North America2022-09-30 13:00:222022-09-30 13:00:222022 Q4 tax calendar: Key deadlines for businesses and other employers https://blog.fiducial.com/wp-content/uploads/2022/09/2022Q3TaxDeadlinesBlogImage_38fae7f71e62e9d0ddc7d4f2c295f860_2000.png

1125

2000

Fiducial North America

https://blog.fiducial.com/wp-content/uploads/2024/02/Fiducial-logo-horizontal-black-300x51.png

Fiducial North America2022-09-30 13:00:222022-09-30 13:00:222022 Q4 tax calendar: Key deadlines for businesses and other employers

https://blog.fiducial.com/wp-content/uploads/2022/09/2022Q3TaxDeadlinesBlogImage_38fae7f71e62e9d0ddc7d4f2c295f860_2000.png

1125

2000

Fiducial North America

https://blog.fiducial.com/wp-content/uploads/2024/02/Fiducial-logo-horizontal-black-300x51.png

Fiducial North America2022-09-30 13:00:222022-09-30 13:00:222022 Q4 tax calendar: Key deadlines for businesses and other employers