HAVING A BAD YEAR? YOU MAY QUALIFY FOR EARNED INCOME CREDIT

Many individuals find themselves earning less during these troubled economic times than in years past. As a result, they may find that they qualify for a credit to which they previously were not entitled because of income limitations.

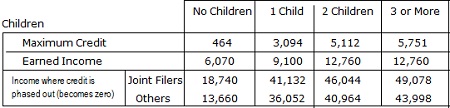

The Earned Income Tax Credit (EITC) is for people who work, but have lower incomes. If you qualify, it could be worth up to $5,751 for 2011. So, you could pay less federal tax or even get a refund. The credit is a refundable credit, meaning you can receive the benefits of the credit even if you do not owe any taxes. That’s money you can use to make a difference in your life and help carry you through hard times.

The EITC is based on the amount of your earned income and whether or not there are qualifying children in your household. If you have children, they must meet the relationship, age and residency requirements. While taxpayers without children may qualify for the EITC, the potential amount of the credit is significantly more for eligible taxpayers who have one or more qualifying children. These taxpayers are also allowed to earn over 2½ times more income before the credit is phased out than are workers without qualifying children.

If you were employed for at least part of 2011, you may be eligible for the EITC based on these general requirements:

The credit calculation is rather complicated and takes into account a taxpayer’s income from working, his or her total income (AGI), number of children and tax filing status. This credit is zero if a taxpayer has no income from working (the credit is devised as an incentive for individuals to work) and increases as the income from working increases until the credit reaches the maximum allowed, at which point it becomes smaller as the income grows. The table below shows (1) Maximum Credit and corresponding earned income and (2) the income at which the credit totally phases out.

To qualify, a taxpayer must meet a few basic rules:

- The credit isn’t available to individuals when their “disqualified income” (i.e., investment income such as interest and dividends) is more than $3,100.

- The taxpayer claiming the credit, and any qualifying children, must have a valid Social Security Number.

- The taxpayer must have earned income from employment or from self-employment.

- Filing status cannot be married filing separately.

- The taxpayer must be a U.S. citizen or resident alien all year, or a nonresident alien married to a U.S. citizen or resident alien and filing a joint return.

- The taxpayer cannot be a qualifying child of another person.

- A taxpayer without a qualifying child must: o Be age 25 but under 65 at the end of the year, o Live in the United States for more than half the year, and o Not be a qualifying child of another person.

- The taxpayer cannot file Form 2555 or 2555-EZ (related to foreign earned income).

- Members of the military can elect to include their nontaxable combat pay in earned income for the EITC. If the election to do so is made, all nontaxable combat pay received must be included in earned income for purposes of figuring the EITC.

The rules related to EITC are rather complicated, and the IRS requires a great deal of information to substantiate qualification. The IRS places due diligence requirements on tax preparers, which are associated with severe penalties. So if this is the first time you have qualified for the credit through this tax preparation firm, you may need to provide information not normally required to prepare your return.

If you have any questions related to how the credit might apply to you, please give this office a call.

Leave a Reply

Want to join the discussion?Feel free to contribute!