Subscribe To Our Newsletter

Join now to stay up to date with the latest from the Fiducial blog!

By submitting this form, you are consenting to receive marketing emails from: Fiducial Blog. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact

Categories

- 1099

- 401(k) plans

- Abatement

- Accounting

- Accrual

- acquisition

- Adoption

- Advisory

- Audit

- Barter

- Bartering

- Beneficiary

- Budgeting

- Business Costs

- Business Deductions

- Business Loans

- Business Owner

- Business Succession

- Calculators & Tools

- cash flow

- Cash Payments

- Charity

- children]

- College

- COVID-19

- Credit Election

- Credit Issues

- Credit Score

- Credit Score Help

- Death of a Loved One

- Debt

- Depreciation

- Disabled Taxpayers

- Disaster Loans

- Dividend

- Dividend Treatment

- Donations

- dual income

- E-Filing

- Education Credits

- Education Planning

- Education Tax Credits

- Elder Care & Planning

- Electric Vehicle

- Employee Benefits

- Employee Wages

- Employees

- Employer

- Employment

- Exit Strategy

- Expenses

- Expensing

- FAFSA

- FICA

- Finances

- Financial

- Financial Help

- Financial Preperations

- Financial Review

- For Business

- Form 8300

- Friendly Reminders

- gift

- Health Care Issues

- Health Care Reform

- Healthcare

- Hiring

- Human Resources

- Income Taxes

- Insurance

- Intern

- IRA

- IRA Beneficiary

- IRS

- Kiddie Tax

- Life Events

- Limited Liability

- LLC

- Loans

- Long Term Care

- Looking to Invest

- M&A Transactions

- marriage

- Medicare

- MediGap

- Merging

- Military

- Missing Participants

- moving

- Nest Egg

- new parents

- News

- Notice

- OBBBA

- Offers in Compromise

- Overstaffing

- Payments

- Payroll

- Pension

- Personal

- Personal Finances

- Pet Tax

- PLESA

- Politics

- profit

- profitability

- Protest

- QSBS

- Record Keeping Tips

- Retirement

- Retirement Planning

- Review

- Roth IRA

- Savings

- Small Business

- Social Security

- Sole Proprietor

- Startups

- Student

- Student Loans

- Supplies

- Supply Chain

- Tariffs

- tax advice

- Tax Authorization

- Tax Benefits

- Tax Breaks

- Tax Calendar

- Tax Central

- Tax Changes

- Tax Credits

- Tax Credits/Deductions

- Tax Deadlines

- Tax Deductions

- Tax News

- Tax Organizers

- Tax Planning

- Tax Problems

- Tax Records

- Tax Scam

- Tax Season

- Tax Terms

- Tax TIps

- Taxable Income

- Taxes

- Third Party

- tipping

- tips

- Traditional IRA

- Transactions

- Travel

- Trust Fund Recovery Penalty

- Uncategorized

- Unemployment

- Vehicle

- Vehicle Credit

- Videos & Info Graphics

- Work Opportunity Tax Credit

- Yearly Earnings

Archives

- February 2026 (2)

- January 2026 (3)

- December 2025 (3)

- November 2025 (3)

- October 2025 (3)

- September 2025 (3)

- August 2025 (3)

- July 2025 (2)

- June 2025 (4)

- May 2025 (3)

- April 2025 (3)

- March 2025 (3)

- February 2025 (3)

- January 2025 (3)

- December 2024 (3)

- November 2024 (3)

- October 2024 (4)

- September 2024 (5)

- August 2024 (5)

- July 2024 (7)

- June 2024 (7)

- May 2024 (6)

- April 2024 (7)

- March 2024 (6)

- February 2024 (7)

- January 2024 (9)

- December 2023 (9)

- November 2023 (11)

- October 2023 (8)

- September 2023 (9)

- August 2023 (12)

- July 2023 (11)

- June 2023 (13)

- May 2023 (12)

- April 2023 (12)

- March 2023 (13)

- February 2023 (12)

- January 2023 (13)

- December 2022 (13)

- November 2022 (12)

- October 2022 (12)

- September 2022 (13)

- August 2022 (14)

- July 2022 (13)

- June 2022 (13)

- May 2022 (13)

- April 2022 (17)

- March 2022 (15)

- February 2022 (12)

- January 2022 (13)

- December 2021 (18)

- November 2021 (9)

- October 2021 (13)

- September 2021 (14)

- August 2021 (13)

- July 2021 (13)

- June 2021 (13)

- May 2021 (13)

- April 2021 (13)

- March 2021 (14)

- February 2021 (12)

- January 2021 (13)

- December 2020 (17)

- November 2020 (13)

- October 2020 (13)

- September 2020 (13)

- August 2020 (13)

- July 2020 (16)

- June 2020 (13)

- May 2020 (13)

- April 2020 (13)

- March 2020 (15)

- February 2020 (13)

- January 2020 (15)

- December 2019 (14)

- November 2019 (3)

- October 2019 (12)

- September 2019 (4)

- August 2019 (9)

- July 2019 (9)

- June 2019 (12)

- May 2019 (24)

- April 2019 (22)

- March 2019 (12)

- February 2019 (13)

- January 2019 (18)

- December 2018 (17)

- November 2018 (15)

- October 2018 (20)

- September 2018 (16)

- August 2018 (17)

- July 2018 (16)

- June 2018 (18)

- May 2018 (20)

- April 2018 (19)

- March 2018 (21)

- February 2018 (16)

- January 2018 (21)

- December 2017 (17)

- November 2017 (16)

- October 2017 (15)

- September 2017 (16)

- August 2017 (17)

- July 2017 (10)

- June 2017 (12)

- May 2017 (11)

- April 2017 (11)

- March 2017 (14)

- February 2017 (14)

- January 2017 (15)

- December 2016 (17)

- November 2016 (10)

- October 2016 (9)

- September 2016 (16)

- August 2016 (12)

- July 2016 (8)

- June 2016 (11)

- May 2016 (9)

- April 2016 (5)

- March 2016 (11)

- February 2016 (8)

- January 2016 (10)

- December 2015 (13)

- November 2015 (9)

- October 2015 (10)

- September 2015 (11)

- August 2015 (8)

- July 2015 (11)

- June 2015 (11)

- May 2015 (10)

- April 2015 (9)

- March 2015 (8)

- February 2015 (34)

- January 2015 (43)

- December 2014 (31)

- November 2014 (42)

- October 2014 (19)

- September 2014 (15)

- August 2014 (8)

- July 2014 (10)

- June 2014 (13)

- May 2014 (7)

- April 2014 (27)

- March 2014 (6)

- February 2014 (33)

- January 2014 (6)

- December 2013 (9)

- November 2013 (7)

- October 2013 (13)

- September 2013 (6)

- August 2013 (10)

- July 2013 (5)

- June 2013 (9)

- May 2013 (7)

- April 2013 (11)

- March 2013 (13)

- February 2013 (55)

- January 2013 (9)

- December 2012 (9)

- November 2012 (7)

- October 2012 (5)

- September 2012 (6)

- August 2012 (7)

- July 2012 (6)

- June 2012 (3)

- May 2012 (7)

- April 2012 (4)

- March 2012 (6)

- February 2012 (7)

- January 2012 (6)

- December 2011 (8)

- November 2011 (8)

- October 2011 (7)

- September 2011 (9)

- August 2011 (6)

- April 2011 (4)

- March 2011 (5)

- July 2010 (1)

- May 2010 (1)

- February 2009 (1)

- December 2008 (1)

- September 2008 (1)

- May 2008 (3)

Providing Educational Assistance to Employees? Follow These Rules

Many businesses provide education fringe benefits to their employees. Do you need information about providing educational assistance to your employees?

Paid Sick Leave vs. Vacation vs. PTO: What You Need to Know

More and more jurisdictions are passing laws requiring employers to provide paid leave to employees. The COVID-19 pandemic has only accelerated this trend.

An S Corporation Could Cut Your Self-Employment Tax

Is your business a sole proprietorship or LLC? Then, you’re subject to income and self-employment tax. Forming an S corporation could lower your tax bill.

New Business? It’s a Good Time to Think About Retirement Plans

Have you recently launched a business? You may want to think about tax-favored retirement plans for yourself and your employees.

Moving to a New State? How to File Taxes After a Relocation

No matter why you are moving to a new state, you can’t forget about taxes. Fiducial has all the information you need about filing taxes in your new state.

Don't Be A Victim to IRS-Impersonating Scammers

Scammers use taxpayers’ fear of the IRS to ply their scams. They try to trick you into divulging your SSN, DOB, and other personal data to scam the IRS.

QSB Stock Gain Exclusion: Who Can Take Advantage and How to Do It

Originally, people considered QSB stock as offering marginal benefits. These stocks now offer opportunities for investors in startups and small businesses.

The US Loses Out On $1 Trillion a Year Due to Tax Evasion, IRS Estimates

IRS Commissioner Rettig says the US may be losing up to $1 trillion/year in evaded taxes. He listed many tax evasion techniques they had not been aware of.

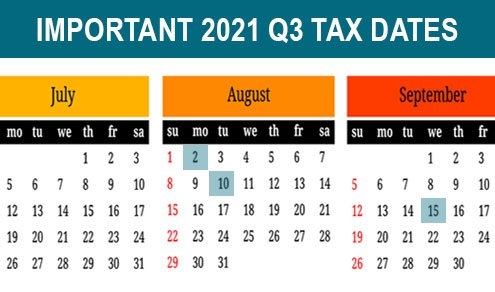

2021 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

Fiducial has the key business-related 2021 third-quarter tax deadlines to mark on your calendar. Don't miss any of these important dates!

Made a Mistake on Your Tax Return - What Happens Now?

Generally speaking, tax return mistakes are more common than you probably realize. Taxes have grown complicated and COVID tax relief has made many changes.

EEOC Addresses Requiring and Incentivizing COVID-19 Vaccination

The EEOC has updated its guidance on employers requiring proof of COVID-19 vaccination and incentivizing employees to get vaccinated.

Do You Qualify for a Tax-Free Grant for Your Restaurant?

The Restaurant Revitalization Fund (RRF) will provide grant funding to help restaurants keep their doors open. Fiducial has more on this valuable program!

Wage Garnishment: Protections and Limits Every Employer Should Know

What do you know about wage garnishment? Are you faced with the imminent prospect of having to garnish a worker's wages and wondering how it all works?

Thinking of Dumping Old Tax Records? Think Again

Tired of having all those old tax records taking up space? Want to dump as much as you can? Find out how long you should keep them.

Understanding Passive Activity Loss Rules and How They Affect You

What are passive activity loss rules and how do they affect you? Fiducial defines passive activities and explains the rules regarding associated losses.

Withdraw Cash from Your Closely Held Corporation at a Low Tax Cost

Owners of closely held corporations be interested in withdrawing cash from their businesses at a low tax cost. Here are some strategies Fiducial suggests.